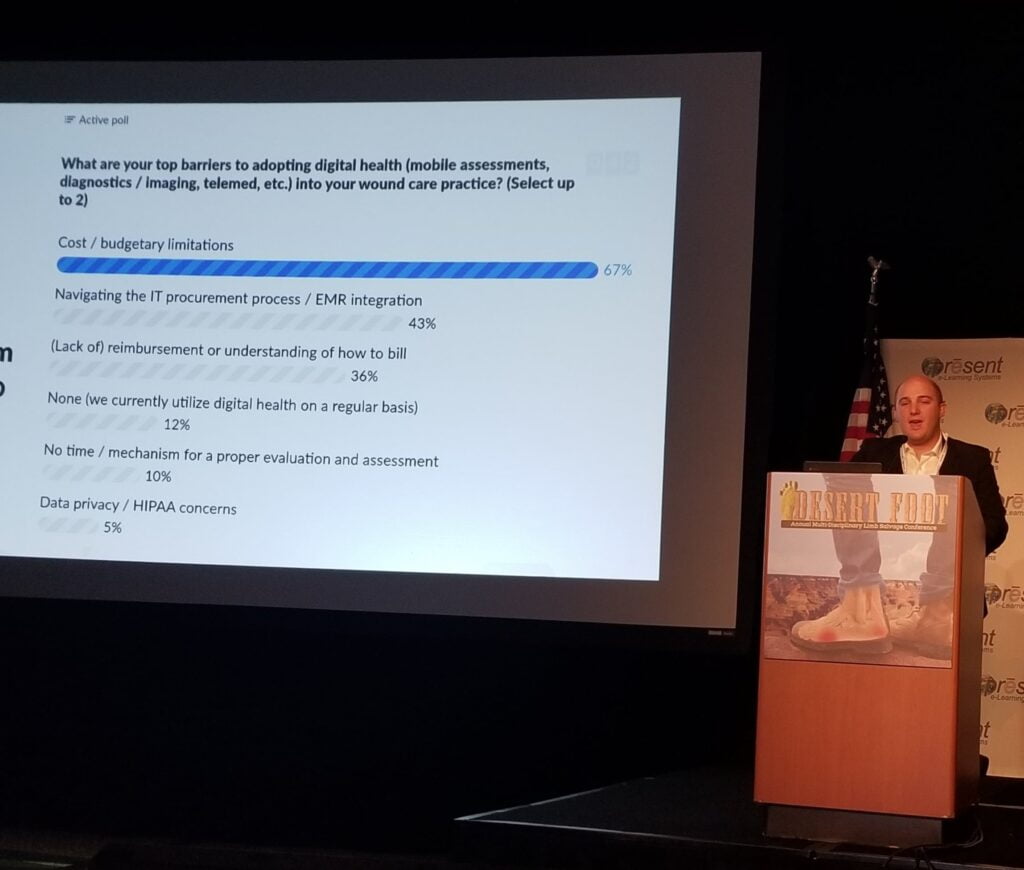

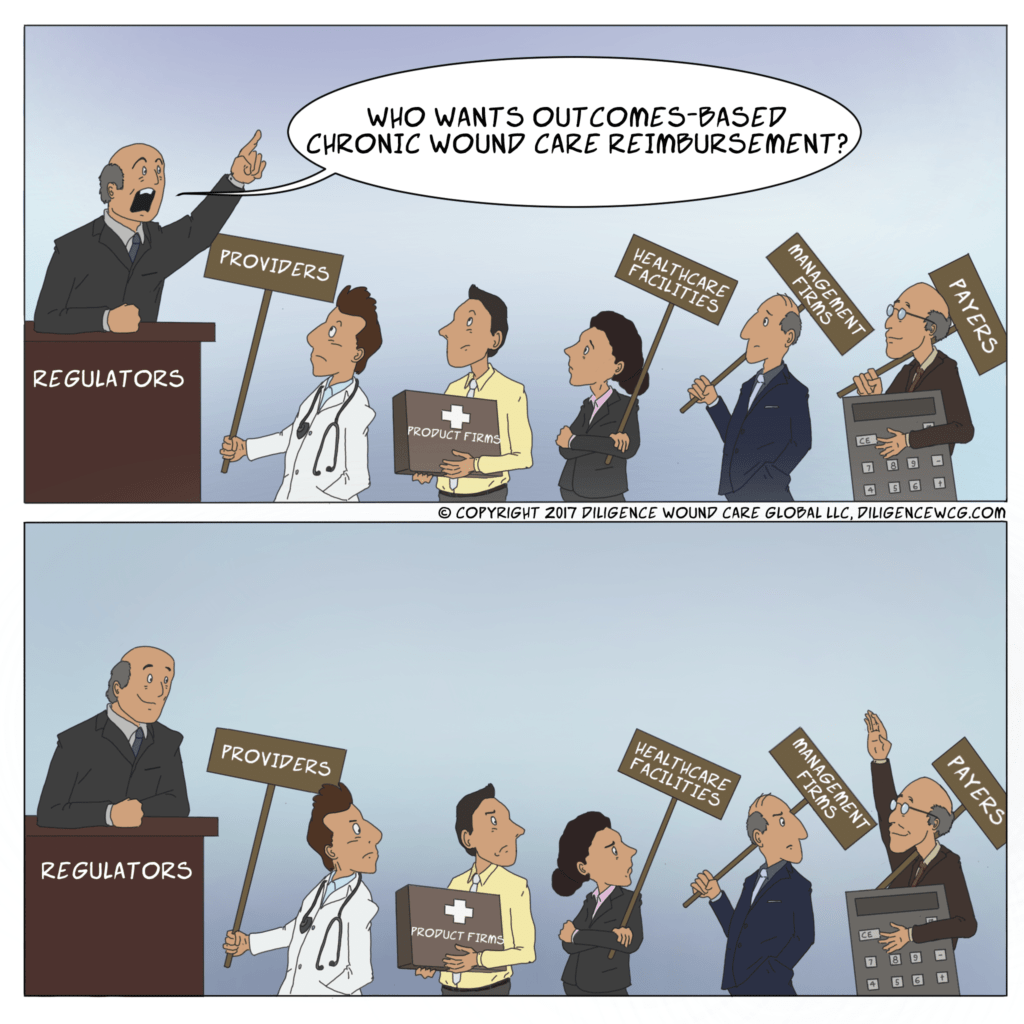

Despite the overwhelming majority of R&D, regulatory, sales, marketing, and corporate finance focus in the advanced wound care (AWC) sector being on physical advanced wound care products, many of the greatest opportunities to drive outcomes–and profitability–exist in the realm of wound care service delivery. This concept was further developed by senior management from several of the leading global AWC brands in the well-received executive panel session we facilitated in Gothenburg, Sweden earlier this year at the EWMA Conference. Keeping with this theme, several of the speaking engagements, articles, partnership explorations, and related advisory we have performed towards the end of this year have revisited this idea. We will share some areas of particular interest below. Calling all forward-thinking AWC professionals Whether you’re in AWC or an adjacent sector (dialysis, diabetes, vascular, ortho, plastics, home care, etc.), or affiliated with a service provider and/or payer organization (ACO, IDN, HMO, CCG, VA)…if you’re seeking to partner with like-minded, forward-thinking executives, payers, health systems / facilities, clinicians, and investors on the types of initiatives discussed in the remainder of this article, get in touch to describe your unique approach and what you and your colleagues stand to gain and could bring to the table. We’ll confidentially use this to explore if there are existing or future collaboration opportunities to accelerate your goals within the Diligence Wound Care Global network. When you have the wound care “Hardware,” but what you need is the “Software” This concept was eloquently articulated a couple of years ago by one of our Singaporean clients…During a tour of several large, well-equipped, generously-staffed, high volume wound care facilities in several countries as part of the early experience program, he witnessed firsthand the lack of administrative support, uniform processes, data analytics, and relative ability to influence key (external) decision makers among the potential customer sites. Immediately after one such customer visit, he turned to me and exclaimed, “They have plenty of ‘hardware,’ but what they need is ‘software!’” In addition to the educational and networking opportunities, we had the opportunity to contribute as faculty at The Association for Advanced Wound Care (AAWC)’s track at The 2019 Desert Foot Multi-Disciplinary Limb Salvage Conference in Phoenix, Arizona earlier this month. One of the topics, Bringing Together Best-in-Class Clinical, Operational, and Technological Approaches to Delivering Advanced Wound Care: An Interactive Panel Discussion, leveraged live polling of the AWC clinicians and administrators in attendance to draw attention to some very surprising yet highly relevant and underappreciated stakeholder pain points and related market needs. Barriers to adoption of new products and technologies Firstly, if you were to ask the average commercial or medical affairs AWC (or more broadly speaking, medtech) professional about the key activities needed to gain adoption, they would likely list the following product-centric factors among their top three replies: Presenting and communicating scientific and clinical evidence Education and training of staff Initial trialing and feedback Strikingly, the live polling results as articulated by actual AWC users and customers suggest exactly the opposite, with their top three barriers overwhelmingly being: [Navigating] administration and bureaucracy Financial pressures to always choose the cheapest or on-contract option Logistics (too many supplies to order, stock, etc.) The audience-reported feedback is consistent with our experience as both an AWC customer and strategist, and is equally as relevant in the non-US markets as it is in the US. Stated differently, even when discussing a topic such as adoption of new AWC products, the key barriers are ironically related to services (management, administration, logistics, etc.). This concept was eloquently articulated a couple of years ago by a Singaporean client, a seasoned global marketing executive in the midst of a best-in-class product pre-launch across nine Asian markets. During a tour of several large, well-equipped, generously-staffed, high volume wound care facilities in several countries as part of the early experience program, he witnessed firsthand the lack of administrative support, uniform processes, data analytics, and relative ability to influence key (external) decision makers among the potential customer sites. Immediately after one such customer visit, he turned to me and exclaimed, “They have all of the ‘hardware,’ but what they need is ‘software!’” The phrase stuck with us throughout that engagement and beyond, anytime we encountered care delivery that was inconsistent, inefficient, unscalable, or otherwise not meeting its full potential despite adequate physical resources (in other words, the vast majority of AWC facilities and providers) . In fact, improving stakeholders’ “software” for delivering care then became a critical parallel activity alongside the traditional “hardware” sales and marketing activities during the actual launch phase, with major dividends in terms of building customer trust and branding for the distributor and their products alike. Clearly, the misalignment on AWC “hardware” (tangible facilities, products, and staffing) vs. “software” (intangible processes, protocols, tech, analytics, business/financial models, and other enablers) is something holding the sector back from its full potential on a global scale–and thus represents a phenomenal opportunity for non-AWC and AWC firms alike. Barriers to adoption of digital health (mobile assessments, diagnostics / imaging, telemed, analytics, etc.) Another highly instructive live audience poll from the event specifically zoomed in on the top barriers to adoption of digital health (literal “hardware” and “software,” not to be confused with the figurative “hardware” and “software” described above). The results are here: Once again, just like with physical product adoption, the most pressing challenges to adoption of digital health faced in the real world are overwhelmingly managerial, administrative, and financial in nature. This begs the question: Why do so few digital health initiatives in AWC actually address these gaps? One might even argue that the majority of AWC digital health creation and marketing activities are not even taking aim at the right problems to solve. But even putting that point aside, can these issues of how to secure budgeting, viable business / financial models, and integrations (both technical and practical) be effectively tackled by individual corporations and health systems alone? At what point does there need to be more cross-pollination beyond just