Coloplast’s acquisition of Kerecis: Considerations and implications

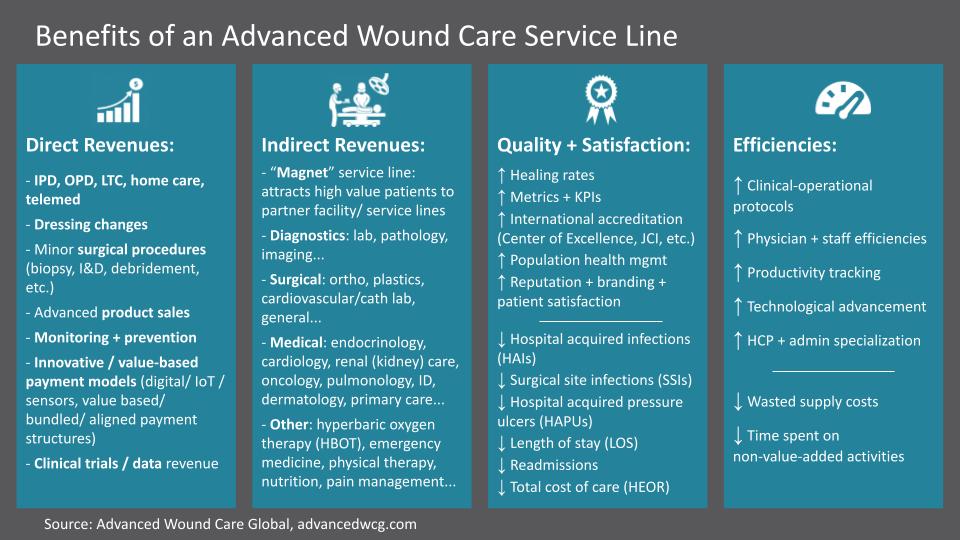

Coloplast’s announcement is the latest large and significant advanced wound care (AWC) industry deal. As the high level details have already been thoroughly disseminated by press releases and news aggregators, our analysis of the Danish multinational’s acquisition of Kerecis will focus on: What makes this deal noteworthy in the context of the current advanced wound care (AWC) landscape and Coloplast’s positioning, especially in the US AWC market? What are the potential tailwinds and headwinds that Coloplast will encounter as they integrate the Kerecis business org, portfolio, and platform? Why is this deal noteworthy? Aside from its 10-figure price tag and a high multiple on revenues relative to other recent AWC transactions, this deal is also a possible tipping point whereby now roughly half of the top wound care MNCs operating in the US now have biologics / skin substitute / allograft / CTPs (cellular and tissue-based products) to their portfolios. (Side note: There is a recent effort, including a consensus paper published in the Journal of Wound Care [JWC], to begin referring to this segment by the more accurate term, CAMPS [cellular, acellular and matrix-like products]). Does this mean that the rest will follow suit? No–and some have intentionally avoided this segment–for very valid reasons as well. On the other hand, it has become clear to most of the major global wound care brands that to simply innovate around the edges of their core dressings and bandages, if they do not have some other competitive advantage (ex: full service logistics, manufacturing, digital health, remote monitoring, etc.), will eventually render them obsolete. However, beyond these relatively surface-level points, this deal is significant for the following reasons: 1. Only a handful of players have successfully achieved commercial penetration at scale There are around 100 advanced wound care CTPs available in the US, which makes up roughly half of the global AWC market overall, and the overwhelming majority of AWC CTPs. However, relatively few players have managed to successfully take this AWC category from concept to successful commercialization in the years since wound care has been on the map with specialized care settings and reimbursement. Indeed, various platforms based on everything from dehydrated porcine, bovine, ovine, and equine (pig, cattle, sheep, and horse) tissues, to autologous cells, cell culture banks, and human cadaver skin, to various amniotic and placental tissues, to collagen derived from bio-engineered plants, to bioactive glass and other synthetic materials have all been shown to contribute to healing in complex wounds and burns. However, of these ~100 products / platforms, only a handful of companies have achieved significant commercial traction to date (some of these companies have multiple AWC CTP products in their portfolios): Organogenesis Smith+Nephew (portfolios acquired from Healthpoint and Osiris Therapeutics) MiMedx Integra Life Sciences Kerecis A few others could be added, depending on the thresholds considered, such as: Convatec (via its acquisition of Triad Life Sciences in 2022) Medline Life Net Health (acquired the combined Bioventus-Misonix-Sol Systems wound portfolio earlier this year) MTF Biologics PolyNovo So out of ~100 technologies, only about ~5-10 have significant commercial traction. Of these, Kerecis and its fish-derived Omega3 platform has been the fastest growing company in this segment for multiple years. 2. International presence + viability Of the CTP companies mentioned above, most of them have virtually no presence outside of the US (OUS), and/or their OUS focus is on a different part of their business (i.e. not AWC / burn care or CTPs). Again, almost the entirety of wound care CTP usage today is in the US. When you attend US wound care conferences, the CTP companies’ booths are among the largest, busiest, and most elaborate in the exhibition hall (and a large proportion of their booth’s footprint if they have multiple product lines). Yet if you attend the increasing number of international wound care conferences (as we do), most of the same companies listed above are nowhere to be found–or perhaps just a small brochure or poster in the corner. Even large multinationals like Smith+Nephew may have a major presence or sponsorship, but they are unlikely to make their CTPs a major commercial focus, in many cases not even bothering to register the products overseas. I won’t go into details here of the many reasons for this, but suffice it to say that they include: Reimbursement / willingness to pay out of pocket Market and stakeholder awareness: of advanced wound care overall, and specifically of CTP use cases for wounds and burns Regulatory, sourcing, logistical, and cultural challenges, for example: some markets require human tissue products to be sourced from local populations, or to undergo a level of material safety processing/testing (ex: heat) that offsets their clinical effectiveness or proper and timely shipping + storage of such products becomes too complex or costly. Sources of cells / tissues may not meet local cultural or religious guidelines However, Kerecis in recent years has been increasingly present in the global wound care markets. Do they make up the majority of their revenues? Certainly not. However, the platform’s pricing elasticity, regulatory, and sourcing characteristics, combined with increased awareness overall, solve many of these issues. As such, in recent years (even pre-Covid), it was not uncommon to see Kerecis–or one of their third party distributors–with a presence at burn and wound care industry conferences across EMEA, APAC, and LATAM. Kerecis also has some complementary, mostly consumer-focused, wound and skin products (that Coloplast can likely competently commercialize through their channels), as well as a pipeline of more complex surgical reconstruction and repair-focused products based on the Omega3 platform. However, the core of their business at the time of the deal is still their fish-derived lines of wound, surgery, and burn grafts. In short, not only was Kerecis the fastest-growing CTP firm in the US prior to Coloplast’s acquisition, but they also were uniquely able to demonstrate at least some initial traction in less traditional and emerging markets where wound care biologics and CTPs

Coloplast’s acquisition of Kerecis: Considerations and implications Read Post »