The situation

Last week (15 Nov 2017), David Bassin (Healogics’ former CFO), was appointed as the company’s new CEO. As the world’s biggest wound management firm and provider of wound services, Healogics has both a massive network and a huge volume of wound care and outcomes data. Understandably, healthcare executives, analysts, and investors watching this space have been very eager to know about what this and other recent developments mean for the future of wound care. This is similar to how major moves by Boeing would be of interest to those working and investing in the aviation industry.

Stakeholders know that change at Healogics, and other wound services firms to some extent, leads to new opportunities. At the same time, it can also expose their business models to new vulnerabilities.

Since leaving Healogics to focus on Diligence Wound Care Global, dozens of clients have turned to us specifically seeking to better grasp strategies and initiatives related to wound management firms (how to react, or what to avoid). From investors and bankers, to startups, to product executives, to healthcare facilities–and to even payers and other wound care services firms–all realize that without understanding how Healogics and other wound management firms prioritize and make decisions and especially how that might affect their short term tactics as well as long term planning, they may be caught off guard.

Bassin is taking the helm during a challenging and unique period in the company’s history: Healogics’ traditional business model is under massive pressure in recent months. Many facilities whose wound programs partnered with Healogics (or its pre-acquisition predecessors) to launch wound care programs five, ten, or even twenty years ago have recently chosen to not renew their wound management contracts due to cost-cutting and other pressures. While a normal churn of contracts won and lost has always been part of the business, Healogics has recently lost significantly more contracts than it has gained–the first major contraction in the history of a company which was otherwise characterized by impressive growth for most of the past decade.

Today, US healthcare facilities have more options than ever for outsourced wound care management–from clinical training and certifications, to clinical-operational flow consulting, to revenue cycle management, to wound care service line marketing, to EHR vendors and mobile health–offering à la carte options in addition to the full-service management approach on which companies like Healogics, Restorix, and others have traditionally focused.

Many–perhaps most–hospitals that do not renew their Healogics wound center management contracts are actually content with the overall services provided. But the ability to, with the stroke of a pen (or more precisely, the lack thereof), cut an annual expense amounting to hundreds of thousands of dollars becomes easier when there are multiple firms that will fulfill specific wound management needs on an à la carte basis. For most US hospitals who are struggling to squeeze even a one or two percent operating margin, the potential savings are material and quite tempting.

At the same time, let’s not discount that Healogics managed nearly half of the hospital-affiliated outpatient wound care centers–though that number is now closer to one third. Centers run by management companies tend to have higher patient volumes and better healing outcomes than their independently managed peers, so it’s quite reasonable that close to 50% of US patients treated in specialized, outpatient hospital-affiliated wound centers are seen in a Healogics facility. Healogics also has a relatively small but potentially growing influence in the inpatient, skilled nursing facility (SNF), and related landscapes.

Perhaps the most significant asset that Healogics has is its healing data. While the à la carte solutions can help solve certain problems, not a single one of them has the A-to-Z depth and quantity of clinical, operational, and financial data that Healogics does. This is important to keep in mind when considering the future dynamics of Healogics, its wound care services/management competitors, and the industry overall. On the other hand, there exist other players with fewer data points but claiming more precise and actionable data such as automated wound measurements. So although the title of “best wound care data set” is yet to be claimed, Healogics is surely a top contender.

The Past: A Brief History of Healogics from 2006 to Today

In 2006, Diversified Clinical Services was born, becoming the largest wound management company following the merger of three smaller firms: Diversified Therapy, Curative, and Praxis Clinical Services. With over 260 hospitals under management, the newly integrated firm had a presence in around 40 US states.

When I joined the company as a wound care center director in early 2011, the Jacksonville, Florida-based company had somewhere around 400 centers under management and was considered one of the fastest growing healthcare services firms in the US at the time.

The growth plan was quite clear: Due to factors such as aging populations, rise in chronic disease, and related lifestyle problems, patients will continue to develop wounds that need advanced treatment. Particularly with all of the baby boomers retiring, the business outlook was strong as long as they were served. Many even believed that within a few years, virtually every hospital in the US would have some sort of formal wound care program.

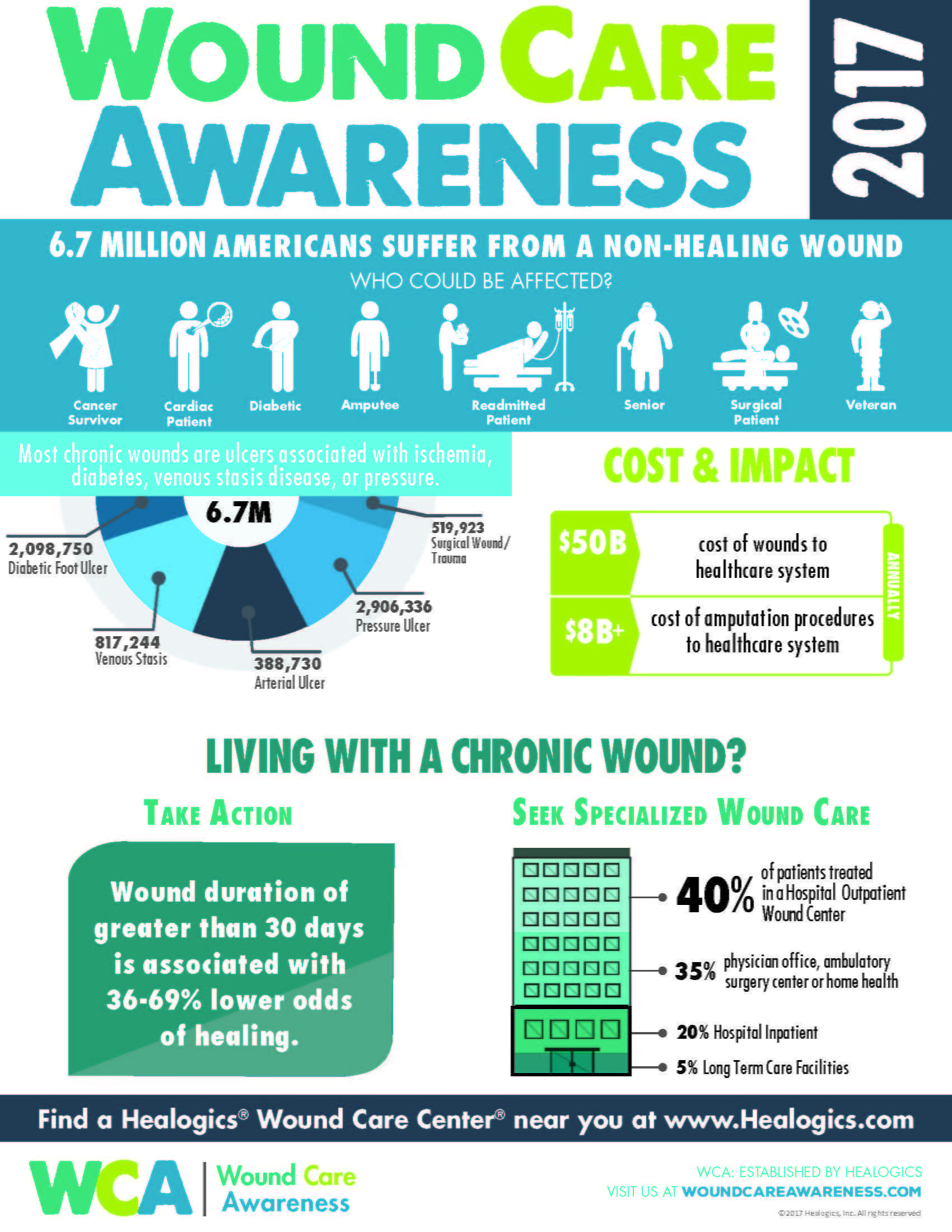

For the most part, they were right. Although the number of difficult-to-heal wounds in the US has skyrocketed to between 6-7 million, the majority are still not treated in a specialized, outpatient wound care center. The opportunity for growth was substantial back then, and still is today. The following infographic, produced by Healogics (and which is consistent with what I have seen working with the industry from other angles, too) visualizes this breakdown:

Another merger with major competitor National Healing Corporation in 2011, and rebranding as Healogics, Inc. in 2012 brought the total to “more than 500 centers” and close to $300M in annual revenue when large private equity player CD&R purchased the firm from Metalmark (another PE firm that had owned it for a few years) in mid-2014 for $910M. By this point, Healogics centers were treating over 200,000 wounds per year.

For my non-finance / corporate strategy audience, allow me to take a moment to explain why this milestone is significant. Companies are often invested in at early stages by venture capital (VC) companies. When they get to a certain point and have proven their model, the VCs exit and the firms begin to enter the realm of private equity (PE) investment (or may jump straight to an IPO, see below). Usually, PE firms want to grow the value of the company within a few years and then either a) sell it to an even larger (group of) PE firm(s), b) do something creative like break up the company into two or more units which can be operated or sold separately, or c) perform an initial public offering (IPO), which lists the company on a stock exchange as a public company. Due to its already high valuation ($910M), and since the nature of the business model and structure was not appropriate for splitting up (basically all revenues came from the management contracts), most of the internal and external speculation at the time was that an IPO would be a likely next step. Some pointed to specialty service line companies such as kidney care/dialysis center management firms DaVita Inc. and Freseneus Medical Care AG & Co as potential case studies to emulate. After all, they had at the time been publicly traded for years, and were still going strong.

Internally, most conversations were quite bullish. With the CD&R acquisition completed, Healogics acquired Accelecare in early 2015, which was at the time its largest competitor. Following the Accelecare integration, the number of Healogics centers being quoted to internal and external stakeholders was “approaching 800.”

That’s when Healogics’ biggest troubles began.

Two whistle-blower lawsuits not only named Healogics, but somewhere between a whopping 500 to 600 or so of their nearly 800 hospital/clinic partners were served as defendants. From my experience being at the firm during that period, I believe the claims in the lawsuits were grossly exaggerated–or perhaps confined to a small handful of centers, not representative of any widespread issues. One of the lawsuits was quickly tossed out, rightly so in my opinion. The feeling communicated from the corporate office, which I too held at the time and today, was that as companies grow and become more successful, they also become more attractive targets for litigation. With Healogics’ explosive success, to some extent, one might say it was only a matter of time before the large-scale lawsuits arrived.

Still, hospital CEOs, risk management teams, and other executives woke up to questions from local media and corporate (system) offices about a lawsuit of which they had no forewarning. Most hospital C-Suite clients at the time understood that the constant threat of litigation is an unavoidable consequence of the US healthcare environment, they deal with them all the time. Yet they typically have months to negotiate and evaluate internally whether the matter could be settled more discreetly and cheaply in private than in court and the media.

But the damage was done. Hospitals hate negative press, especially when they have no advanced notice or time to prepare a response. For urban and suburban hospitals, it makes them look bad when compared to their regional competitors. In the case of rural hospitals, it becomes “the talk of the town,” and can distract from other initiatives in an already cash-strapped area.

Multiple customers who were unsure about renewing their Healogics contracts decided not to as a result. This led to many of the wound care management and consulting firms with the flexible, à la carte model referenced above receiving an unexpected windfall of business around that time, with the lawsuit as the catalyst for hospitals to reevaluate their options.

The Present: Identifying and Understanding the Changing Landscape

Another relevant dynamic important for stakeholders to understand is the following: The relative value of a traditional, full-service wound care management contract generally diminishes over time. Think about it. If a hospital has no wound center and a management firm can help them along that process: planning, budgeting, design, staff and provider education, documentation and revenue cycle management, sales and marketing support, etc., it is of huge value. But once the center has been built and opened, with a few years worth of financial and operational experience under its belt, some of that value is no longer relevant.

Arguably, the majority of US wound centers in operation today would never have opened were it not for management firms like Healogics to explain and facilitate that process. But many of the financial planning, space layout design, provider recruitment, and clinical training become less appreciated after years of operations, especially as new leadership that was not around for the service line launches arrive in the hospital C-Suite. While the lawsuits and other factors may have triggered hospitals to take a close look at their wound care management contracts, this phenomenon is what moved many of them to actually take action.

After five or ten years under a wound care management contract, many hospitals have been asking, “Why are we now paying a wound care management firm significantly more in fees [which are often linked to volumes] than ever before? We should now pay them less, because we now rely on them less than when we started.” During the same period, per-patient/per-visit revenues have decreased, in some cases challenging the whole concept of fee-for-service healthcare around which the traditional wound management business models were built.

New healthcare payment model experiments, such as Maryland’s Global Budget Revenueaffecting all hospitals in the state, are not aimed specifically at wound care services. Yet they still have the effect of disincentivizing hospitals to increase variable fees (whether staffing, products, or variable-fee outsourced management contracts). The upside to this model has been Medicare savings of $116M in its first year of operations alone.

As someone who was involved in Maryland (as well as non-Global Budget Revenue regions’) hospital-based wound care centers, I saw the impact in hospital planning and decision making before, during and after the Global Budget Revenue rolled out. There were of course downsides and adjustments, such as tempering annual revenue growth. Yet overall, hospitals have been able to simultaneously reduce some waste and inefficiencies, while being able to better plan for capital expenditures and strategic investment–though they’re still nowhere near becoming “well-oiled machines.” Hospital administrators have learned to appreciate the ability to anticipate and plan for capital and operational expenditures without waiting until the month is closed just to figure out their volumes…and yet another two months after that just to determine how much revenue they collected from payers.

I predict that with Maryland having been the guinea pig for this model, other cash-strapped states with quickly-rising healthcare costs may turn to this system or something similar. This could include California, Illinois, Massachusetts, Michigan, New York, and others, and might have a significant impact on management and related wound (and non-wound) healthcare firms.

Managed service line contracts with variable-fees will be among the first casualties of such a shift. True, statewide and/or federal regulatory changes will not happen at lightning speed, but sustainable yet profitable wound services models are not born overnight, either. When the changes do come around, there need to be feasible wound care business models in place for all stakeholders involved, or major industry disruption will be inevitable.

Unfortunately, these developments go directly against the prevalent traditional wound management services model, which has been to invest heavily in centers when they first open, and to then reap the rewards in the long term, when most centers require fewer management resources.

In my experience working on both the wound management side and the healthcare facility side of the equation, it’s not usually a case of, “You’re fired!” but rather, “Might we simultaneously reduce our management company invoices by 50%, and reduce the services we receive from them by 50%?” Or, “Our hospital’s financial model has changed so that non-volume based metrics are increasingly influencing of our revenues. The result is we can’t grow revenues more than a couple of percentage points per year–could we cap or incentivize our management services invoices in the same way?” If the answer to either or both of these questions is “no,” then the decision may be made for a management transition or to shift to an independently-managed program.

Many–probably most–hospitals who do not renew their Healogics and other management contracts do not do so because they were unhappy with the service provided. On the contrary, in most cases, they’re very pleased, or at least satisfied. Rather, they now have more à la carte options that allow for more flexibility. This has been a major growth driver for smaller yet fast growing players such as Wound Care Advantage. Healogics’ structure and business model does not currently lend itself to such a flexible model–though recent developments may cause them to rethink that, and might determine that if correctly implemented, such a model could shift them back into growth mode.

To be fair, from my vantage point across multiple angles in the industry, most hospitals who end up cancelling their wound care management contracts discover weeks, months, or even years later that they had been benefiting from services whose value they did not fully appreciate until it was too late. A major advantage of hiring a large firm like Healogics is the regulatory and reimbursement oversight and advisory that (usually) prevents systemic documentation and billing errors which might come back to haunt a facility months or years later if not regularly audited and processes improved. The average US hospital does not have the in-house specialized revenue cycle management expertise to stay on top of these types of developments. When they get hit with a mistake, the fallout can sometimes dwarf what they had been paying in management fees (although the management company is an extra layer of defense–not definitive prevention).

Along with other factors, the above dynamics led to the first-ever major contraction of the total number of Healogics facilities under management. The firm’s historical operating assumptions have been challenged, leading to an urgent need for financial, operational, and human resources stabilization. In addition to high and costly field staff turnover, several senior executives, including both company veterans and new talent, have also cycled in and out in recent years.

Recent regulatory and legal developments have further tested HBOT volumes, a key driver of revenues–and a dominant contributor to EBITDA for both Healogics, as well as its healthcare facility customers. Articles such as this one (which do not properly frame the issues or fairly present both sides of the story) further criticize the rising costs of HBOT and other wound care products, yet more often than not fail to properly convey the seriousness of the wound care epidemic, the complexity of the patients treated, or the costs associated with failing to aggressively treat wounds. Regardless, the negative PR has put additional pressure on major wound care product and services players.

This comes despite the fact that the overwhelming majority of chronic wound care patients are government insured (Medicare, Medicaid, TRICARE/Veterans Affairs, etc.). This reality has made business model innovation in US wound care even more sluggish than with other medical sub-specialties and service lines with a higher proportion of privately insured patients. For example, Walmart has since 1996 been partnering with healthcare delivery leaders such as Cleveland Clinic, Geisinger Medical Center, and Mayo Clinic to provide heart and spine surgeries to its associates with demonstrated simultaneously improved outcomes and reduced cost.

Despite the many challenges, it is important to keep in mind that as of this writing, Healogics is still by any measure a leader in likely the fastest-growing segment of US health care: advanced wound care. The company’s investments in recent years may be beginning to pay off, including: direct employment of wound care providers, expansion into new care sites, and potentially more openness to partner with industry and payers to capitalize on the huge amount of data that it collects. Healogics’ recent announcement to launch the Wound Science Initiative is likely not a coincidence. Some internal forces had been pushing for years to increase Healogics’ involvement in research, development, and post-marketing data for wound care products and other therapies. Some competitors have been gaining traction in that area over time. So to me, the timing of when this Wound Science Initiative announcement took place during the management transition is quite significant. Unless it is a pure coincidence (a distinct possibility), it likely signals a potential shift in both strategy and those who influence it.

We must also acknowledge that both: 1) companies are rarely able to maintain explosive growth for multiple consecutive years, and 2) many of the hospitals who wanted to open a wound center had already done so in recent years; either with Healogics, a competing wound care management company, or independently. Therefore, the remaining addressable market–in terms of hospital-affiliated wound care centers, not the total wound care market–is much smaller than it was ten or fifteen years ago. Still, the company’s new private equity owners and much of the senior leadership were caught off guard by such a significant slowdown in what had one of the hottest healthcare firms in America at the time.

The Future: What to Expect and Where to Look?

Full disclosure: I know hundreds of current and former Healogics employees, and keep in close touch with over a dozen. But as of this writing, I’ve never actually met or spoken with new CEO David Bassin. He joined Healogics not long before I left the firm.

Bassin began his career in audit for Arthur Andersen LLP, soon thereafter specializing in healthcare-related finance. When he joined Healogics, his experience in audit, M&A / corporate integrations, private equity, and public healthcare firms caused a lot of buzz that Healogics had brought him on board to prepare for an IPO and/or another round of acquisitions. Still, there were several other senior Healogics executives claiming in private that given the business and capital markets environment at the time, the company was at least several years away from such a move.

Having minored in computer science, Bassin is surely aware of the huge asset that Healogics’ data set of millions of wounds and healing outcomes is and can be in the future by monetizing retrospective clinical trials, product usage data, predictive analytics, telemedicine, and more.

On the other hand, as the CEO of a wound analytics startup recently told me, “Everyone talks about wound care data, but what those who have done a deep dive into it know is that the current data is so noisy and complex, it’s still extremely difficult to come up with reliable predictive algorithms and artificial intelligence besides product comparisons.” Inaccurate and inconsistent wound size measurement data is likely one contributing factor to this. Variations in provider approach and technique, patient comorbidities, timing / effectiveness of interventions, and host factors such as nutrition, psycho-social status, patient compliance, and other relevant factors can be difficult to capture and control for even in the most robust data sets available today.

Healogics has been working with major academic institutions to review and analyze their data for years–but I’ll admit it’s not clear to me if the relative absence of applying those insights to solve real wound care challenges–or even to increase revenues–is due to: a) Inertia (“We’ll focus on that after we sell the company again or take it public–for now let’s continue to do what worked for us in the past.”), b) legal / regulatory / reimbursement considerations (“There’s a lot of good data out there, but we don’t want to ‘open up that can of worms,’ and doing so won’t improve the way we get paid in the short or mid-term, anyway.”), or c) lack of actionable insights (“We have taken a hard look at the data, but there is not much that we can materially apply from it to our business.”).

I suspect it’s primarily a mixture of (a) and (b), as one of the few cases of their published data to to inform clinical-operational practice was the largest-ever study of its kind ever and well-received at the time, Frequency of Debridements and Time to Heal: A Retrospective Cohort Study of 312 744 Wounds. This study confirmed on a very large scale that debridement improves healing outcomes. High debridement rates can also coincidentally boost the profitability of an outpatient wound care center. As such, the data was presented as evidence to providers in centers with simultaneously poor healing outcomes, low debridement rates, and under-performing financial indicators (all benchmarked against the hundreds of other centers in the Healogics network). But this is one of the only instances in which Healogics’ proprietary data was used to drive clinical-operational-financial outcomes company-wide.

From where I sit, the main focus of Bassin’s work in recent months has been to “right the ship” and stabilize the bleeding from the simultaneous unexpected loss of contracts, HBOT volume drops, stalled growth, slower-than-anticipated traction with the SNF, practice management, and inpatient initiatives, and lawsuit fallout. Operationally, the company’s financial model was shocked by depth of the wound (pardon the pun). In fact, the majority of investment professionals who have contacted Diligence Wound Care Global as part of their due diligence cycle on this topic this year are from the credit–not equity–side of finance.

This caused internal distress and the departure (both intentional and unintentional) of significant field and corporate talent. The corporate office has in recent months made more of an effort to connect with the vast majority of employees who are field-based, which has historically been a blind spot for the firm. Having done so earlier could have potentially anticipated and avoided some of the issues that came up in recent years which reversed the company’s trend of successful growth. But better late than never. The key question will be whether it will result in processes to improve the speed and dynamics of Jacksonville’s reaction to changes in the field when the early warning signs are first evident.

Aside from the lawsuits, most of the challenges and threats were well-articulated at the field level but not properly digested and implemented at the corporate level to prevent the exodus of clients. If Healogics is able to significantly improve the firm’s ability to rapidly distill and act on those cues, it will be able to successfully treat one of the underlying causes of its current predicament. This is not an easy task given the nature of its business. If it fails on either of the two (effectively listening or formulating a solution), then yet another business contraction or other negative outcomes are likely.

Following a proper financial-operational stabilization, there are a number of potential initiatives on which Bassin and his team can focus. Aim too high, and the company risks distraction and inability to execute. Aim too low, and the business model will drown in the regulatory, reimbursement, competitive, and other forces that are stirring.

Key Questions To Ask

While many of the past and present challenges above are unique to Healogics, most of the future questions to ask are relevant to every wound care services firm wishing to become influential and/or a leader in this space. Some of the strategic initiatives that Bassin and his team–as well as their partners, competitors, and other stakeholders–have in front of them for consideration and prioritization include:

- What value can we extract from our wound outcomes data, and to what extent might we share / sell that to others (product firms, payers, regulators, hospitals, SNFs)?

- How aggressively should we voluntarily pursue outcomes-based and/or risk-sharing in our revenue model, or would we be better off waiting for it or another model to emerge as imminent or mandated (refer to cartoon above)?

- Might we ally with other stakeholders (refer to cartoon above) skeptical of outcomes-based wound care to preemptively offer a payment model that is somewhere between fee-for-service and outcomes-based?

- To what extent should we be open to partnering with product firms (the product firms are extremely open to that idea), and if so, should that be an R&D/clinical outcomes partnership, a monetization one (they currently monetize just one product: HBOT), or another model?

- Should we pursue additional M&A in the short term?

- If so, should we position ourselves as the acquirer or the target?

- Should we focus on other management firms (like Restorix, Wound Care Advantage, and Serena Group), product companies, payers, other specialty service companies (vascular centers, dialysis centers, pain clinics, physical therapy centers, ambulatory surgery centers, etc.), mHealth/telemedicine firms, wound care provider firms, or other partners and structures?

- To what extent should our future growth come from wound care centers vs. inpatient programs vs. SNFs vs. home health vs. telemedicine and other care sites?

- Would our interests be better served by proactively renegotiating our contracts to be better aligned with future hospital incentives–which despite a lot of talk might take many more years to materialize in a material way–or do we focus on driving operational and other efficiencies to better compete within the existing model?

- Likewise, must we preempt wound care business model innovation? Or is it OK to wait until the regulatory and reimbursement future is more clear?

- To what extent will non-clinic care sites be part of our model in three to five years (they’re currently very minor)?

- How can we improve the severe level of turnover among many of our field-based positions, and do we need to make a major adjustment to our standard staffing model (over the past eight years, the field-based position titles posted on the company website have been virtually unchanged aside from the city in which they are recruiting)?

- Do we want to attempt to (re)grow the quantity of outpatient centers under management, or are we better off fine tuning what we have and focusing on other drivers of revenue?

- Is opening our own, Healogics-branded centers (where it’s feasible under current regulatory and reimbursement mandates) a good path forward–or will that cause our existing partners to become upset and take up too many of our currently limited resources?

- To what extent do we in-source our EHR and related IT solutions, and will the potential benefits be worth the required investment, or do we risk burning resources on and becoming distracted by something that is not our core competency?

- Likewise, what is (are) our core competency(ies) and competitive advantage(s), and would we be best served trying to maintain and nourish them, or should we instead develop (a) new one(s) positioned for what we anticipate as the future wound environment?

- To what extent do the competitive advantages we articulate to our internal and external stakeholders truly differentiate us and provide those stakeholders with a practical edge or other value?

- If we are not satisfied with the answer to the previous question, then should we focus on (re)strengthening those articulated competitive advantages, or would our stakeholders be better served by us (re)focusing on new ones that are more relevant given the company’s and our customers’ current situations and the external environment and dynamics?

- Can and should we provide more product selection and formulary streamlining advisory to our hospital partners to potentially offset the expense incurred by us managing their wound center (and if so, should we contract with specific product companies, or keep such an initiative to within the hospital’s decision making system)?

- To what extent can (and should) we leverage our strengths internationally (Healogics dipped its toes in UK healthcare some years ago, but success there so far has been mixed at best), and how much of our offerings (regulatory, reimbursement, revenue cycle management, documentation, training, clinical flow, network effect, etc.) lose their value when removed from the US healthcare system?

The Past Does Not Dictate The Future

After a decade of light-speed growth (by US health care services standards), Healogics and other leading management firms have indeed faced some major obstacles recently, but they also have the potential to emerge stronger and larger than ever.

In hindsight–which “is 20/20”–some of these could have been avoided (like the failure to anticipate and plan for the contract renewals challenges) but others (like the lawsuits) were in large part due to the uncertainty of the healthcare system, business environment, and an overall litigious society.

In fact, one might even suggest that most of the greatest challenges facing Healogics today are simply a direct result of its tremendous success over the past decade. Indeed, there are many reasons to be optimistic about the future of wound care management services overall.

On a personal and professional level, I am extremely appreciative of the opportunities and experience gained at Healogics. It was in my 5+ years with the firm that I was able to gain firsthand knowledge of the wound care and related environment: the patients, the clinicians, the administrators, the product representatives, the payers, and the other care sites. This formed the cornerstone of what would later become Diligence Wound Care Global, the world’s leading wound care advisory firm.

In terms of patients and the wounds from which they suffer, Healogics was integral for putting the field of specialized advanced wound care on the map. Many of the top wound care centers in the US are independently managed. But from my experience, on average, patients heal faster and are less likely to “fall through the cracks” at a managed wound center such as Healogics. I think most wound care professionals and consumers can appreciate the concept of, “you can’t manage what you don’t measure.”

Moreover, I have witnessed supposedly excellent wound care programs based in major teaching hospitals and other academic institutions with large budgets. Many times, the outcomes at a community hospital down the road that consistently applies best practices and benchmarking are actually far superior and more consistent. Then again, facilities with abundant resources and advanced technology have their advantages, too. In the end, the variable with the biggest effect on outcomes and performance is probably the clinical and administrative team.

Wound care product firms are counting on Healogics and other management firms’ success as well. In an article earlier this year, I charted how the growth of wound care product revenues so far this century has grown hand-in-hand with the rise in US specialty wound care centers. When Healogics announced an interim CEO a few months ago, I was contacted by executives from most of the major US product firms to assess what that means for their existing business and what new opportunities they should pursue as a result.

Still, many executives and investors with whom I work are already looking beyond the US for future wound care opportunities. Particularly in the emerging markets, the lack of expectation for advanced wound care reimbursement actually opens up many unique opportunities: Some of the most exciting new products are being launched outside the US first. The lack of strict EHR regulations and overall adoption of mobile technology has also accelerated the potential for mobile wound care and telemedicine adoption at a rate far exceeding that in North America and Western Europe.

Conclusion

The path forward for the wound care management business–of which Healogics is at the forefront–is actually not unlike the delivery of advanced wound care itself. When a patient comes in with a wound, an effective wound care team must:

- Properly assess the entire patient and diagnose the wound. Surgical and traumatic wounds may not heal because pressure is not effectively offloaded. A visibly shallow wound may have a severe underlying bone infection. An arterial ulcer that is incorrectly diagnosed and treated as a venous ulcer can turn a small wound into a limb amputation or death. If wound healing is stalled or worsening mid-treatment, it is crucial to go back and re-assess the underlying cause(s). Those of us who have expertise in the clinical wound care management side of this industry see this as an axiom, not a theory. Why should the business of wound care be any different?

- “Treat the whole patient, not just the hole in the patient.” Even when the most visible causes of the wound are confirmed and addressed, there are still multiple factors that can impact healing. That’s why they’re often called “advanced” or “complex” wounds. Even if kidney function, smoking, uncontrolled blood pressure, malnutrition, substance abuse, pain, emotional distress, socioeconomic challenges, and other factors may not have initially caused the wound, they often contribute to stalled healing. Likewise, in the time that a company determines and addresses the primary root cause of a business challenge, new problems may arise or their impact more profound. These too must be addressed as part of any turnaround or growth strategy.

- “Measure what you manage.” I suggested above that on average, clinical and other outcomes tend to be better at wound centers with some level of professional / regional management involvement than those who are independently run. It’s not that the administrative and clinical staff at one type of site are smarter, harder working, or better trained. Neither are the patients necessarily healthier or more compliant with their treatment. Product and advanced therapy availability is also relatively similar across US wound centers. Yet there is something about measuring, benchmarking, and being accountable for negative trends–and incentivized for top performance–that is important in any business where customers have the ability to choose–whether in the automotive, hospitality, consumer electronics, or healthcare services industry. Most of the wound care management firms do a good job of benchmarking their facilities against each other, rewarding the top programs and mentoring the under-performers (even replacing leadership and staff if warranted). But how many of them effectively measure, analyze, and continually improve against their own corporate competitors (whether other management firms, or independent facilities that have innovated or out-performed)?

As the relationships between wound care product, service, and payer firms becomes increasingly blurred, new doors are opening as well. The epidemic of difficult-to-heal wounds will continue for the foreseeable future. As by far the largest player in this space, Healogics has an opportunity to truly drive business models and care delivery. Even if the number of contracts under management were to continue shrinking, that may not necessarily be a bad thing if the firm can simultaneously reach a greater number of of patients with wounds, and do so across care sites.

Still, there are several interesting wound management firms that have been focusing on the non-clinic wound care sites (SNFs, home health, telemedicine, etc.). In some cases, they are growing at rates similar to early 2000s Healogics / predecessors / competitors. Certain corporate moves could exponentially strengthen Healogics’ window of influence–or it could be eclipsed altogether.

The recent developments are the latest news in what is perhaps the most exciting area of US healthcare. As entrepreneurs, investors, and corporations race to discover and execute the best solutions, I truly wish success for all of the players involved, and not just from a business and investment strategy point of view–millions of patients and their families are counting on them.

Do you think that Healogics’ size and reputation make it an important player to follow in the US wound care space, or do you feel that these are less influential than other factors? What new models would you like to see them (or others) try? What do you think have been the main contributing factors to their recent challenges, and (how) do you think they will evolve as a result? What other companies might Healogics merge with / acquire / be acquired by, and how might that affect wound care delivery in the US? Which wound care sites do you think the major management services firms should focus on? Comment below!

[This article was originally published on LinkedIn on 23 April 2017].