Advanced wound care’s position in the evolving COVID-19 landscape

Global economies have been slammed by COVID-19 in the first part of the year. Some biomed sectors, such as PPE, respiratory, and telemed solutions, have seen unprecedented demand for increased production/availability and new innovation alike. On the other hand, orthopedics, plastics, and other service lines with a traditionally large mix of elective consultations and procedures, have absolutely been hit hard. Generally speaking, healthcare systems have taken a hit as they shift clinical resources from their most lucrative revenue drivers to critical care preparedness and treatment.

However, when it comes to the supply and demand interplay of COVID-19 on the advanced wound care industry, the results are more nebulous. Even across geographies, the question of whether wound care is an “essential” service line is currently being interpreted differently, depending on who you ask. For example, in several countries across Europe, most wound care clinics are closed. In the US, most wound care clinics remain open–though a significant number are operating on a part time (ex: Tuesdays and Thursdays only, or only half-day hours). Of those operating on a full-time schedule, many are seeing significant patient volume reductions compared to the same period in 2019. From both operational and commercial perspectives, the implications are significant. Forward-thinking executives and investors need to understand and actively plan for the possible scenarios and consequences of their actions (or lack thereof).

The operational data, on-the-ground insights, and their implications

[T]he keenest wound care executives and investors use real world data not just for making claims about physical products (though that is important, too). By combining data analytics with on-the-ground insights to stress test operational and commercial hypotheses, firms can stay one step ahead of the news cycle. The result is the ability to out-plan, out-invest, and out-compete in the wound care arena, and to be prepared for the possible consequences of their moves.

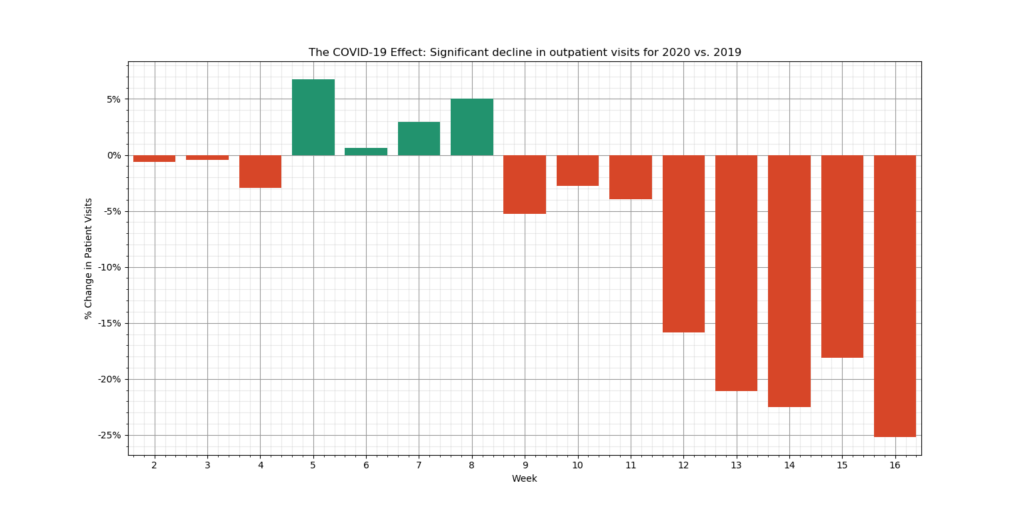

Anecdotally, year-over-year (YOY) volume reductions range from 10% to 40% or more. The figure below shows data, collected and analyzed by Tissue Analytics from across several US clinics that use its wound care measurement and assessment software. It shows a very clear YOY reduction in weekly patient visits of around 5% in early March 2020, steadily growing to 25% as of 17 April 2020 (the most recent data published as of this writing):

According to Tobe Madu, the Tissue Analytics data scientist who conducted the analysis, “For this analysis we looked at outpatient clinics since these are the facilities most likely affected by the COVID-19 lockdown mandates. Only clinics that were fully integrated with Tissue Analytics as of the first week of 2019 were considered. The data points presented in weekly intervals corrects for daily fluctuations and reveals a clear decreasing trend for patient visits.”

Of critical importance is also the notion of whether the reductions in patient encounters are among existing patients who may be told by their providers to come at less frequent intervals (ex: fortnightly instead of weekly), or perhaps the patients themselves decide to skip appointments, ostensibly due to COVID-19 fears. Likewise, relaxed US telemed reimbursement and restrictions allow for easier remote monitoring and consultations even as clinic-based visits dip. In such cases, we might expect to see a short-term stabilization once a new comfort level in terms of visit frequency vs. COVID-19 risk is met. Clinically, wounds may heal more slowly (lower frequency of debridement, fewer advanced product applications, less utilization of HBOT, etc.), but would supposedly still allow for effective patient triage in most cases.

Alternatively, are patient volume reductions driven by a reduction in new wound care patient admissions to the clinic? In other words, are patients in treatment during the early months of of 2020 continuing to come as normal until healed (around ~8 to 15 weeks on average, depending on the case mix and clinical outcomes of the particular facility), yet new wound patients are hesitant to schedule their first appointment? If this is the case–which my gut told me is more likely–then we might expect a continued patient volume free-fall, combined with a major risk of tragic clinical outcomes (including amputation, sepsis, and death) from delayed treatment in the coming weeks and months. Many of these patients will eventually burden emergency rooms, inpatient acute care units, and SNFs, who will inevitably treat the fevers, weakness, elevated white blood cell counts, and other presentations as COVID-19 until test results and a full clinical assessment confirm that the patients’ neglected wounds are the more likely root cause of the symptoms.

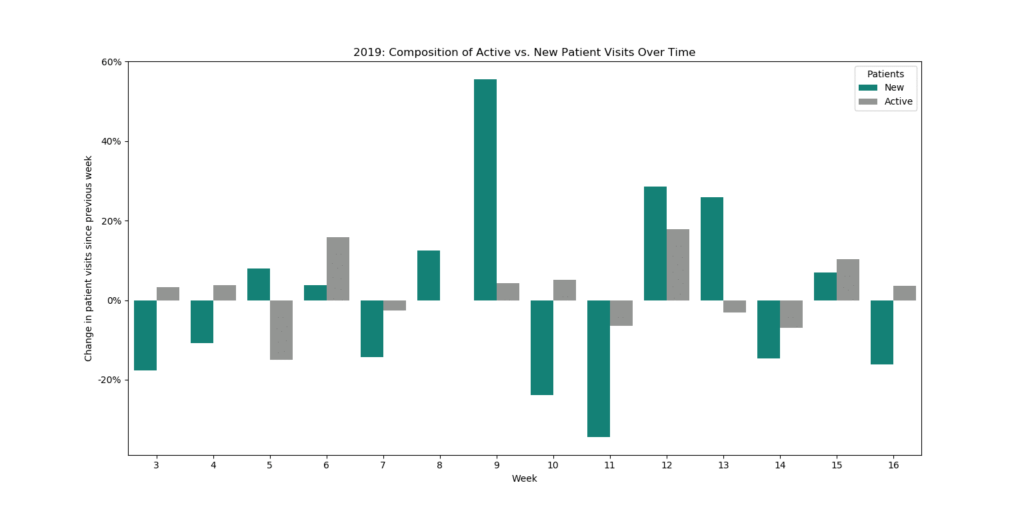

I asked Tobe from Tissue Analytics about my hypothesis: That patients already receiving treatment pre-pandemic may be likely to continue, but that new patients with wounds may not be scheduling new admissions. If so, then the drop in patient visit volume would be likely to continue beyond the current 25%. Tobe was able to work his data analytics magic to dig into this, too:

Tobe further articulated what the above data visualizations tell us:

“When we compare the pre-lockdown (wks. 3-11) and post-lockdown (wks. 12-16) period, new patients account for 15% of the decline in average outpatient clinic visits per week. Last year, for the same time period, new patients represented a mere 3% of the increase in total patient visits. The decline in new patient visits appears to be a legitimate concern moving forward even though new patients only represent ~10% of the patient population.”

Of course, a larger facility sample size and a few more weeks of data would be beneficial. Likewise, Tissue Analytics’ outpatient customer base may skew towards larger, IT-resourced health systems. Having said that, the data pattern suggests one of two possibilities, either:

- We may not yet have seen a bottom for outpatient wound center visit volumes. Wound care center operations are fueled by new patient admissions. If new patients are not being admitted to post-acute settings (a good amount are likely ending up in acute settings), then we might expect an ~8-15 week lag for the most severe impact on patient volumes to materialize (though of course there are many variables such as the tone of media coverage and developments regarding regional lockdowns). This will trickle down to advanced products that are often ordered / applied in clinic settings, including NPWT, CTPs, outpatient autografts, compression therapy, and even certain brands of advanced dressings.

- Alternatively, the most medically vulnerable and/or risk averse patients may be the ones not showing up in the initial weeks of Covid. Such patients may simply be delaying their treatment by a few weeks to see whether the situation worsens or improves, in which case the volumes may stabilize relatively quickly, and may also have a large geographic variance (this analysis did not segment geographically, though that’s certainly something that could be performed for a particular analysis).

A key point here is that the keenest wound care executives and investors use real world data not just for making claims about physical products (though that is important, too). By combining data analytics with on-the-ground insights to stress test operational and commercial hypotheses, firms can stay one step ahead of the news cycle. The result is the ability to out-plan, out-invest, and out-compete in the wound care arena, and to be prepared for the possible consequences of their moves.

Keep in mind that some wound care facilities are operating at full capacity, in many cases overbooking to compensate for higher cancellation rates, while maintaining a normal schedule. Among clinics that are closed or on partial schedules, a major driver we have seen is that outpatient clinical staff is being allocated to inpatient medical units in anticipation of potential surges. From the patient perspective, non-caregiver visitors may not be allowed in the facility and/or patient room (this is typically a facility-level policy, not unique to wound care centers).

Early research has shown that patients with comorbidities commonly associated with complex wound patients such as diabetes and cardiovascular disease, who may not have had COVID-19 prior to their arrival to the ED, are at heightened risk of severe and fatal COVID-19 infections. This presents a difficult situation: If wound care patients are exposed to COVID-19 in the wound clinic, they are statistically in more serious danger than the average person. On the other hand, their risk of infection and strain on healthcare resources is likely much higher should they be treated in the emergency room or other acute care settings.

Dr. Lee Rogers largely agrees, sharing his perspective in a piece he penned for Podiatry Today earlier this month:

“…[W]ound care expert[ise] is even more important now during the pandemic…Hospitals are expecting an influx of patients with the COVID-19 virus in the coming weeks and months, and are taking action to limit other services so they can surge to meet the demand…In my opinion, the pre-pandemic goal of wound care seemed to be ‘wound healing at any cost.’ However, during the pandemic, the goal is shifting to ‘avoiding hospitalization at all cost.'”

[Update: Shortly after this article, Dr. Rogers and colleagues published a related article, “Wound Center Without Walls: The New Model of Providing Care During the COVID-19 Pandemic”].

The commercial impact

Even in regions and facilities operating on normal schedules, industry is–with some exceptions–restricted from visiting. Those who are able to do so are typically for supporting specific procedures, not for general product in-services. To offset this in part, there has been a visible increase in remote educational events sponsored by industry. Multiple senior wound care product executives with whom I have spoken have indicated that they are reevaluating their needs for a large field-based sales force, even post-pandemic.

In terms of industry conferences and exhibitions, all of the major ones have either been postponed to later this year, or transitioned to virtual formats. In fact, WoundSource‘s WoundCon Spring 2020 (held on 2 Apr), which was announced as a virtual event pre-COVID-19 (back in Nov 2019), had over 13,000 HCP registrants, in addition to industry sponsors and attendees. Even if travel and gathering restrictions are eased later this year, it remains to be seen whether industry–many of which halted non-essential business travel weeks before government mandates–will attend in full force. Likewise, to what extent will clinicians attend, and how might that impact marketing budgets (convincing arguments could be made in either direction)?

While industry leadership is understandably concerned about the mid-to-long term impact on their businesses, many executives are using this as an opportunity to sharpen the axe, by focusing on strategic planning / advisory board sessions, as well as internal competency development. In light of this, we partnered with Healiant Training Solutions to deliver our proprietary and well-received The Business of Wound Care content via an eLive interactive webinar. The first one, held on 17 April, was a huge success. The next one to be held on 27 April, is sure to be equally valuable, with many questions about COVID-19’s impact on AWC commercialization coming from the audience. Details follow:

One clear AWC commercial winner in all of this is telemed and remote patient monitoring solutions. Some industry players cobbled together apps and other tools as soon as restrictions were put in place. Several firms had already planned initiatives for months, simply accelerating the launches during the lockdown. Yet others have already been providing patient-facing tools for remote monitoring and telemed for some time, and have simply accelerated and expanded access to the tools that are already live.

During this current COVID-19 pandemic, telehealth wound and ostomy management company, Corstrata, has experienced a significant increase in demand across all of its customer segments – post-acute providers, payers, and advanced wound dressing and ostomy manufacturers. Corstrata’s unique telehealth solution is ideal for virtual management of wound and ostomy patients who, because of the COVID-19 pandemic, are unable to access care in the usual settings of outpatient wound care centers or physician offices. I have been enthusiastic about the opportunity for remote wound and ostomy management expertise since long before the novel coronavirus began impacting patient care. For sure, the new clinical, administrative, and financial (PDGM and PDPM) realities since then will only serve to accelerate its adoption.

In the words of Corstrata Cofounder and Chief Revenue Officer, Joseph Ebberwein, “This current crisis has accelerated a tech-enabled model of wound and ostomy care which was inevitable as we shift from fee-for-service to value-based care- the use of technology to create access to remote specialists to improve clinical and financial outcomes.” Additionally, Corstrata has seen an increase in interest from various venture and strategic investors.

According to Cofounder and Chief Executive Officer, Kathy Piette, “Corstrata’s leading-edge value proposition is appealing to investors that desire to have a telehealth or e-consult solution in their portfolio given the significant increase in telehealth and virtual care, not only in the physician space but also in the management of patients with chronic conditions, such as wounds or ostomies. The Centers for Medicare and Medicaid, under the leadership of [Administrator] Seema Verma, has dramatically changed the landscape of telehealth and its adoption. Fortunately, this new reality will surely persist well after this pandemic.”

Even as many commercial initiatives and sales force expansions are temporarily (in some cases permanently) put on hold, areas such as business development / business model innovation and digital health initiatives are moving full speed ahead.

How is industry reacting, and how might executives and investors best move forward?

In addition to investing in strategic planning and competency development (see above), on 17 April 2020, I recorded a video with some additional wound care industry insights for HMP Global’s Wound Care Learning Network COVID-19 Resource Center:

COVID-19 Industry Commentary: Part 1

COVID-19 Industry Commentary: Part 2

Topics covered in the video analysis include:

- Directives and policies implemented by some of the top global advanced wound care brands during the COVID-19 pandemic.

- Tactics and new product use cases we are seeing from the field, including repurposing / new use cases of wound dressings and ointments to prevent and treat injuries and irritations from prolonged wearing of PPE by clinicians.

- Fallout and how firms are reacting / plan to react mid to long term.

- DME, home care, and telemed strategies that are gaining interest and preliminary traction in the field.

Conclusion

Advanced wound care occupies a unique place in the spectrum of healthcare products and services. Most would agree that its provision is far from “elective,” yet as the scientific and medical community races to better understand COVID-19, the proper balance between risk vs. reward for physical consultations and procedures is still an unknown, especially given the complexity of many patients with complex wounds.

To further complicate things, mostly as a result of archaic regulatory financial incentives that have only begun to be relaxed, most wound practitioners are not used to delivering sustained wound care remotely, especially for vulnerable patients who may struggle with both technology usage as well as physically accessing (reaching) their wound. On top of that, there exists a dearth of advanced wound care diagnostics and products, from remote patient monitoring to active interventions, that are effective in remote settings.

Companies who had only passively considered such options need to be rethinking them, from the perspective of their corporate and portfolio strategy, as well as the onboarding, training, and tactical management of sales, marketing, and clinical product specialist staff. Health IT and related services invested in need to properly integrate into the clinical workflows of customers, most of whom are already operating at atypical capacity, with new apps and other tech thrown at them from multiple directions. All this, even as many wound care clinicians are being tapped to assist in other care settings, at least for the time being.

While most of the medtech and health services focus has been on other parts of the health system, and there are certainly fewer traumatic injuries and burns occurring in recent weeks, the tens of millions of patients with complex or non-healing wounds globally have not gone away. Those companies who can skillfully navigate this new landscape to address those needs, while alleviating burden on clinicians and the overall system dealing with COVID-19, are most likely to create significant stakeholder value in 2020, despite a very rocky start.

How is your wound care organization (products, services, or digital health) impacted by COVID-19 so far? What are you seeing and hearing in the field and in the boardroom?

Are you an investor looking to talk through which firms stand to gain vs. are disproportionately exposed to business model risk during the pandemic?

Leave a comment and/or contact us to discuss your unique wound care business situation. Pandemic or not, be sure you don’t get hit with bad wound care business decisions.

Well written Rafi! Excellent insights and data suggesting a new patient engagement structure is necessary to improve patient compliance/treatment and curtail WC-related costs on the other end of Covid 19.

Thanks, Shri! Yes, the repercussions of the pandemic will manifest themselves well beyond the surface-level impact to patient volumes. Complex wound patient concordance / compliance was already tricky even before COVID-19. Now it’s impacting behavior even before they hit the hospital or clinic, adding yet another variable for clinicians, executives, and investors to contend with!