(26 Apr 2016) Following is part 2 of 3 in a series of posts reviewing emerging advanced wound care and regenerative medicine trends and some key implications for the future of the industry. Part 1 focused on emerging wound diagnostics approaches. Part 2 will analyze corporate strategy and positioning among the major wound care players. Part 3 will look at emerging innovative therapies, trends, and opportunities.

Putting things into perspective

I’m fortunate to interact regularly with sales representatives, product specialists, regional managers, and executives in both clinical and corporate settings. But there is something unique and valuable about attending key industry conferences and trade shows. The ability to walk around and see each firm’s portfolios showcased, to play devil’s advocate with product managers, chief science officers, and CEOs, then to walk over to another booth and toss their competitors’ talking points at them, yields priceless insights. Beyond investor presentations and press releases, seeing corporate strategy and competitive dynamics in the exhibition setting is an inherently valuable experience that puts industry trends in perspective like no other.

US advanced wound care is unique

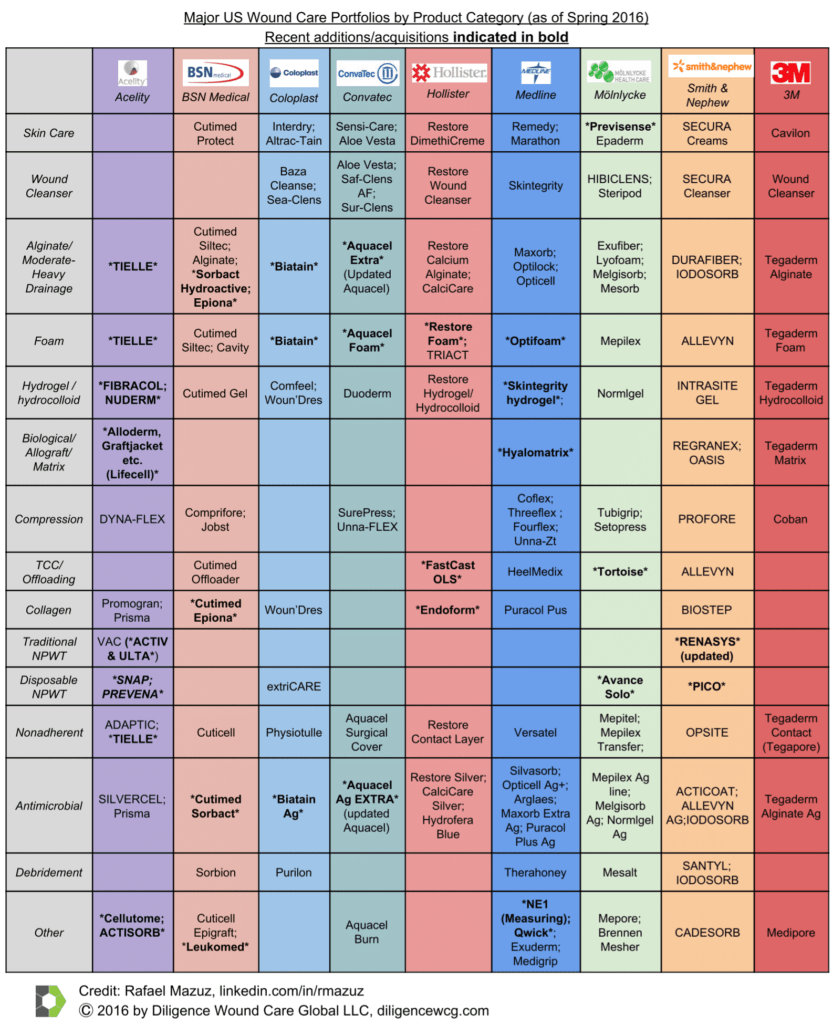

By my analysis, there is no segment in US healthcare expanding their portfolios and product lines faster and more intensely than advanced wound care. To this point, I have created the following chart which lays out the major product lines by category, highlighting some of the recent portfolio additions and acquisitions among the major wound care players. It also shows where each player has potential gaps in their portfolio (to be discussed below). This chart will serve as a reference for the rest of this post:

Assembling comprehensive portfolios

Corporate competitive dynamics are in full swing in the advanced wound care space. Being in a heavily regulated industry, costs of compliance and sales are tremendous. As a result, once companies have overcome market entry regulatory hurdles, they are under massive pressure to ramp up sales in order to capture market share and generate a satisfactory ROI on their costly investments. There are two primary incentives for companies to have comprehensive wound care portfolios:

Firstly, when a brand and its sales force have successfully penetrated care sites and captured market share, economies of scale allow add-on products to be sold at a lower marginal cost (because the accounts and relationships already exist). This is especially true for product classes that do not require a large amount of end-user education (such as skin cleansers, foams, alginates, collagens, etc.).

Secondly, having a comprehensive portfolio allows for companies to negotiate broad, competitively priced contracts with clinics, SNFs, home health agencies, hospitals, and even entire healthcare systems/ACOs (which we have increasingly seen during the end of 2015 and into 2016). As long as a firm’s sales force is not overwhelmingly distracted by the quantity of products or care sites, there is usually value in having multiple related and complementary products in their “bag.”

If the quantity of products grows too large, there are ways to deal with this scenario as well. Strategies include segmenting reps by: a) care site (inpatient vs. outpatient vs. SNF vs. home health, etc.), or b) by product category (dressings vs. allografts vs. NPWT, etc.). Due to the inherent overlap between both care sites and products used, I generally consider it valuable to have at least a small portion of the sales professionals’ bonuses linked to team performance, which incentivizes collaboration and cross-coverage (but too much may disincentivize top performers, which is a huge risk).

The above incentives are significant. Combined with the overall growth and trajectory of the need for wound care in the US, the result is virtually all of the major firms racing to fill holes in their current portfolios, with a goal of most of them to ultimately become fully integrated wound care product providers.

Identifying the trends: predictions and competitive dynamics

There are a number of important wound care trends that can be inferred solely based on the above chart–but there are also other aspects of corporate strategy, culture, and even the personalities of individual executives to consider. These can have a significant impact on each firm’s strategy.

To claim that every firm has the goal of filling every product category is overly simplistic and probably not the case. However, there is a clear overarching trend towards assembling comprehensive wound care portfolios because of the economies of scale and distribution synergies discussed above, as well as due to the evolving clinical and financial landscape. For the remainder of this post, I’ll discuss some of the related trends that I have observed and deduced.

Trend 1: Product categories and future predictions

As US wound care moves towards bundled payment models, many vendors will likely take a more active part in the risk sharing for healing outcomes. In my opinion, future products most likely to be acquired/licensed by the major players will need to be highly cost effective while of course influencing positive clinical outcomes. Specifically, I predict that the most significant activity will be in the following categories: 1) Offloading (total contact casts (TCCs), positioning, etc.); 2) Skin care and wound cleansers; 3) Disposable NPWT; and 4) Wound diagnostics (the topic of my recent post).

Lately, there has been an enormous volume of new biological/allograft products hitting the US market. Many of these have been driven by recent changes in the fee-for-service reimbursement model for this product class. Bundled payments will once again cause a shift in usage. This clinically important yet relatively expensive category will continue to play an important role in wound healing, but the focus will shift towards those products with attractive associated characteristics and costs (not just purchase price, but storage ease/cost, preparation/application time, etc. as well). Vendors of these products may even introduce new pricing and distribution models, such as only receiving payment if the product results in certain clinical outcomes, or packaging diagnostics with the product, which might better match the right patient with the right product at the right time.

Other high potential innovations such as SevenOaks Biosystems’ outpatient full-thickness autologous skin grafting system (based on technology developed by dermatologist and photomedicine pioneer Rox Anderson, which is currently used in medical lasers) will likely have key roles in product portfolios because they simultaneously decrease the wait times and costs associated with clinically important procedures traditionally relegated to the operating room. [Update: SevenOaks Biosystems has since been acquired by Medline].

Trend 2: Corporate competitive dynamics

Medline: Medline, which enjoys a leading large scale medical supply distribution position, has been aggressively adding products to its advanced wound care portfolio over the past three years, while simultaneously improving the quality and range of existing product categories such as their honey dressings, compression bandages, and foams.

Among their recent portfolio additions, Medline is actively promoting Hyalomatrix, an allograft product which is quite cost attractive (low per unit cost and applications every 2-3 weeks), versatile (indicated for most of the common wound types), and convenient (can be stored long term at room temperature), with solid clinical outcomes (based on what I have experienced in the clinical setting).

Vertical integration is a unique advantage that Medline has over the other leaders in advanced wound care. Being a major hospital distributor, it is able to identify trends based on customer purchasing data. Medline then simply prioritizes and rolls out similar, price competitive versions of those products. Medline has access to the data of who is ordering each product, how much is being ordered, and what they’re paying for it. This allows them to minimize both the cost and length of their sales cycle for advance wound care products.

Two illustrative case studies of this strategy in action are: medical honey and hydroconductive (wicking) dressings. Medline launched its Therahoney and Qwick product lines to capture market share from two well-known, fast-growing wound care brands which it was distributing to its customers: Derma Sciences‘ MediHoney and SteadMed Medical‘s Drawtex, respectively. Leveraging internal distribution data enabled Medline to determine: a) demand for these products was high and growing fast; b) which facilities were ordering these items; and c) at what prices, quantities and frequencies.

Armed with this data, Medline was able to drastically reduce the education and time investment needed to sell these product types, directly targeting existing purchasers and applying part of the savings realized to offer Medline versions at competitive price points. While there is plenty of debate as to what extent the products are close clinical substitutes, it is a matter-of-fact that Medline was able to quickly and inexpensively capture a piece of market share from its more cost sensitive customers.

Medline has used similar tactics when rolling out its compression, foam, collagen, and other product lines, eroding market share from the established leaders in each category. This is a real point of contention among many vendors, who will sometimes attempt to request that customers use an alternate distributor for their products. However, doing so often requires additional supply chain management approvals that a busy administrator or provider may not have the time (or incentives) to seek.

Clearly, Medline’s status as a preferred distributor throughout many healthcare systems and facilities is a unique, vertically integrated competitive advantage. If past behaviors are an indication of future actions, we are likely to see a similar approach to upcoming Medline product launches as it moves to fill the remaining holes in its portfolio.

Mölnlycke: Mölnlycke, a Swedish brand best known for its high quality foam dressings (and related product lines), recently added two key product classes to its portfolio: NPWT and offloading, as well as a soft launch of a new skin care product. Mölnlycke clearly felt pressure to diversify since Acelity, Coloplast, Convatec, Hollister, and Medline recently launched competitive foam dressings, threatening its core product line.

While Mölnlycke’s Avance Solo hybrid NPWT device (single-patient disposable, yet with a larger canister and profile similar to traditional NPWT) is clearly aimed at capturing market share from Acelity and Smith & Nephew, its recent acquisition of Sundance Solutions’ offloading and positioning products also allows it to defend the encroachment of multiple foam competitors (Smith & Nephew is promoting offloading as an ancillary benefit of its ALLEVYN Life foam line as well). By adding product categories that are especially useful for pressure ulcer treatment (NPWT and offloading/positioning), Mölnlycke is both defending against new foams in the market, as well as taking aim at pressure ulcer prevention and treatment, a crucial wound type for advanced wound care customers given the projected demographic and reimbursement trends.

Although Mölnlycke may not be the most aggressive player in the field, it absolutely has shown high standards of product quality and consistency, and has a solid reputation as such. It will be interesting to see if it continues to unleash competing products in other categories such as allografts, TCCs, disposable NPWT, and others–or if it will stay with a more “slow and steady” approach (its new offloading device is named “Tortoise” after all), with fewer, yet high quality, products and a continued focus on foams, its core product class.

Smith & Nephew: Smith & Nephew, the well known British ortho, trauma, sports med, endoscopy, and wound care firm, has been putting a great deal of resources into promoting its disposable PICO NPWT against Acelity’s disposable SNAP NPWT (acquired from startup Spiracur in December 2015). Disposable NPWT has become an important emerging category of wound products, both for its ease of use, reduced logistical headache (compared to traditional NPWT), and potential for use in emerging market wound care.

Smith & Nephew is also focusing heavily on the latest generation of its ALLEVYN foam dressing line (called “ALLEVYN Life”) for pressure ulcers, which claims to not only absorb drainage, but to offload the wound as well. Smith & Nephew is an established brand with a broad portfolio and significant international presence. These strengths, combined with its ability to provide solutions across a variety of surgical specialties in addition to advanced wound care, create synergies that potentially give it several competitive advantages compared to the other firms discussed in this post.

However, the firm also sometimes has a perceived sense of competition, or at least a lack of coordination, across its wound care segments. One instance of this is how the reps selling advanced wound dressings (AWD) are not generally the same as those selling PICO, preventing them from working in concert. Another example is its Regranex biological being sold against its Oasis allograft/matrix product (which it acquired in December 2012), due to their overlapping indication for diabetic foot ulcers. To be fair, there are regulatory and practical barriers to a full integration (one is a pharmaceutical, the other is a medical device). But the end result is a potentially powerful, comprehensive portfolio that can come across to the customer as siloed instead of the fully integrated solution for most advanced wound care needs that it truly should be.

With such a wide range of products to sell, getting internal stakeholders to present external stakeholders with harmonious solutions can be a huge challenge. But I believe that Smith & Nephew’s ultimate success or failure in this space will depend much whether it either ultimately: a) Integrates and leverages its existing and planned product lines, sales, and marketing efforts to create synergies and value for customers and other stakeholders; or b) allows its approach to become increasingly segmented, making it difficult for providers and facilities to navigate the full range of solutions, thus losing out on the value that its portfolio has “on paper” but can struggle to realize for its customers.

Smith & Nephew is a solid company with a global reputation. Yet a sometimes splintered and competing sales force means it is currently leaving synergistic value on the table in the current and future environments. I will be watching closely to see whether the firm is able to improve its incentive structure and alignment, which will directly affect its ability to leverage a solid portfolio and brand in the changing advanced wound care space in line with its scale and potential.

Hollister: With its aligned core product segments of ostomy, continence, wound & skin, and ICU, Hollister was especially focused at SAWC on promoting their new TCC system, called FastCast OLS (offloading system). While many claim that it is a bit bulkier and more cumbersome to apply than competing products, it does have several practical advantages over its competitors: 1) Patients do not need to turn over during application, 2) an enhanced offloading plate to reduce pressure on the wound, and each system comes with 3) an Endoform dermal matrix, and 4) a Hydrofera Blue foam dressing. So in theory, it is really a complete diabetic ulcer solution–at least in terms of the wound location–and at a competitive price point.

As the industry moves towards outcomes-based payments, I predict we will see more leading firms aggressively add TCC and other offloading solutions to their portfolios, as it is one of the most clinically and cost effective modalities for treating diabetic foot ulcers.

(Above: Hollister, with its Restore Foam, FastCast OLS, and Endoform product launches, does not have the flashiest product portfolio, but it does offer reasonably-priced clinical solutions across most of the wound care spectrum)

BSN Medical: One of the most interesting corporate strategies in the industry is that of Germany-based BSN Medical. Traditionally known for their compression, splint, and casting categories of vascular, wound care, and ortho products, the company has taken an interesting marketing approach recently: They have invested heavily in clinician and provider education, but not in order to advance a fancy new allograft, offloader, or NPWT device. Instead, they have been focusing their education efforts around their non-medicated, antimicrobial Cutimed Sorbact line of dressings and related products.

Rather than focusing on high-education cost, high-revenue items, BSN Medical is marketing their entire portfolio as an alternative to silver dressings and products. Silver, as many in the industry know, has been the subject of much debate in recent years, with its bactericidal properties being weighed against its potential toxicity and high costs. Instead of introducing a single silver alternative yet continuing to sell other silver dressings (such as Hollister does with its Hydrofera Blue line while continuing to sell its Restore Silver line), BSN Medical has taken a unique approach. They are heavily investing marketing and education resources not in a single product or group, but rather in their entire brand and messaging.

By promoting a “silver-free” approach to their entire portfolio, BSN Medical is taking a significant risk–but one that so far seems to be paying off. It is positioning itself as a clinically innovative yet cost-effective vendor for the majority of the modalities employed for most wound patients. They would benefit from adding a wound cleanser product that is in line with their brand messaging, too. Regardless, they likely will continue to be a serious contender for the ultimate wound care portfolio title.

Acelity: Arguably the most aggressive recent plays have come from Acelity. Since the merger-acquisition of the KCI, LifeCell, and Systagenix brands and its 2012 divestment of hospital beds to ArjoHuntleigh AB, the company has executed a restructuring of its sales force, better aligning them across the range of care settings. Of all the major wound product companies, Acelity is also the only large vendor that is purely focused on the healing/regenerative medicine segment.

Acelity is now able to offer fully integrated solutions to healthcare systems, which include a full spectrum of NPWT, wound dressings, epidermal harvesting, and allograft products. Some key product categories, such as skin care, wound cleansers, and offloading, are still missing, but these should not be too difficult to fill if they want to, considering their global presence.

As a result of their new scale, and in order to capture market share for the newly integrated brand, Acelity is actively approaching hospitals and healthcare systems to negotiate cost-attractive, broad contracts for the largest categories of wound care products (something they were unable to do when they were three separate, focused firms). Regardless of whether they ultimately go through with their announced plans for an IPO, Acelity CEO Joe Woody has confirmed his interest in continued acquisitions, positioning Acelity as one of the fastest moving players to keep an eye on in wound care.

Exceptions to the trend: Are they really exceptions?

You may be thinking, “But not all of the major players are aggressively ramping up their portfolios! Even based on your chart above, BSN Medical, Coloplast, Convatec, Smith & Nephew, Molnlycke, and 3M each only rolled out one or two new product categories recently…” On its surface, this is a fair point. However, if we look at the larger context, some key nuances become clear:

1) Base portfolios:

Prior to the recent wound care frenzy, the above companies had relatively comprehensive portfolios to begin with. So the aggressive moves by Acelity, Hollister, Medline, etc. can be seen as necessary to catch up. The other players may have the luxury of time to assess trends or perhaps develop solutions via in-house R&D, but this does not mean they are not actively investing resources to maintain market share in this environment.

2) Types of gaps:

Not all wound care categories are created equal. Adding a skin care, foam or collagen product to one’s portfolio to create economies of scale is a much less risky move than adding a complex allograft, offloader, or NPWT. The former categories can more easily be acquired/licensed and integrated into existing portfolios and sales channels. The latter categories have much higher costs of quality assurance, distribution, and clinician education. Furthermore, adding products from the latter categories risks distracting a firm’s sales force from their core product group, which can lead to a loss of market share from their “bread and butter” categories. Finally, products such as cleansers and skin care are less complicated in terms of their supply chain and cost of sales, so there is less advantage to being a first-mover in these “add-on” categories. Therefore, for companies who had relatively solid and diverse portfolios to begin with, the decision to only add one or two products in recent years may have been a prudent one. They did not necessarily need to move as quickly as the ones with major portfolio gaps, but should not be misinterpreted as complacent or lacking a sense of urgency, as they now invest substantial resources to defend their positions.

3) Cultural/international:

While all of the companies in the above chart have both US and global offices, it is not a coincidence that the ones with relatively less US activity are primarily European companies (Germany, Denmark, UK [x2], Sweden, and US respectively).

Even 3M (the sole US-based firm in this group) is a huge multinational conglomerate, with less than 18% of its 2015 net sales coming from healthcare (and only a fraction of that was from wound care) according to its 2016 annual report. Moreover, 3M (the conglomerate, not their healthcare division specifically) saw 64% of total revenues from overseas in 2015, with 40-45% expected from emerging markets by 2017. In other words, 3M is a significant player both in the US and internationally, with several product categories manufactured and sold. Yet as a firm, its overall corporate strategy is not driven by wound care (or even healthcare) alone, as opposed to a more focused firm such as Acelity (whose entire portfolio is wound care and regenerative medicine related) or others, for whom wound care is a significant portion of their total business. So the fact that we have recently seen the most aggressive US moves by the firms who are both US-based and more focused in their wound care business scope makes sense when viewed as part of a broader cultural and international context.

International wound care strategy and tactics is a fascinating topic on its own, and will therefore be discussed in greater detail in a future post. But for now, suffice it to say that large wound care firms with non-US headquarters, or for whom specialty wound care is a small part of a much larger business unit, may execute their US wound care strategy on a relative delay. This is due to both the extra level of corporate approvals needed, as well as due to their broader international focus. And we can’t blame them: As exciting as USD $10 mil sales of an innovative new biological or allograft product may be, focusing resources instead on a USD $1 bil emerging market for basic foams, collagens, or wound cleansers may well be a prudent strategy–especially for global companies with an established presence and reputation in those regions (3M is a great example of this). It’s no coincidence that the less agile (from a corporate development standpoint) companies in the US are among the leaders in wound care in the international markets.

In the above context, it makes sense that some large wound care firms have been more aggressive in the US than others. Yet the industry as a whole is moving at a breathtaking pace.

Conclusion

The race to assemble comprehensive advanced wound care portfolios is heating up. We have highlighted several product categories as being especially high potential for continued activity and growth. We also looked at some of the major movements among the largest wound care firms, and put them in the context of their portfolio profile, competitive dynamics, and cultural/international considerations.

Other major international wound care players also exist, such as Daewoong (South Korea), Alcare (Japan), and Urgo Medical (France) that have varying levels of comprehensive portfolios and are also able to aggressively compete on pricing. But these firms currently lack any significant US presence and therefore were not discussed in this article (yet they all have significant sales and market share in many of the international markets and could theoretically enter the US as well at some point should they choose to).

As the US healthcare system’s transformation towards cost control and bundled payments continues (some of the international markets are moving slowly in this direction as well), the firms best able to assemble the most value-added, balanced, and complementary portfolios will likely have strong competitive advantages in driving usage and creating stakeholder value–both in the US and international markets.

Business development scouts and strategy executives from all of the major companies were at SAWC Spring in full force, hungry for emerging technologies and therapies to add to their rapidly growing product lines. Being on the front lines of the industry, I look forward to continuing to both observe and be directly involved in this exciting, evolving space.

This was Part 2 of a 3-part series following Spring SAWC 2016. View Part 1 and Part 3.

In which wound care product categories do you expect to see the most future activity?

Which of the major wound care firms do you think have the most well planned and executed corporate strategies and why?

Are there potential future categories not described above that you believe we might see in the future (or perhaps currently in development)?

Please comment below.